Top 5 Insurance Products on the Ugandan Market

https://lutakome.com/wp-content/uploads/2020/06/5.jpg 724 454 LUTAKOME LUTAKOME https://secure.gravatar.com/avatar/391166e609081ac85d6984740316d403?s=96&d=mm&r=gTo most people insurance is what it is and that’s why many times people are disappointed when they a report a claim only for it to be denied because they purchased the wrong class of insurance for the risk they are facing.

If you are in any way involved in the insurance sector whether you are an agent, broker, client or researcher, you may find this information is very useful because it does indicate those insurance products that most Ugandans have embraced highly and in this error of technological disruption you may discover those products that are most likely to be impacted by innovation .

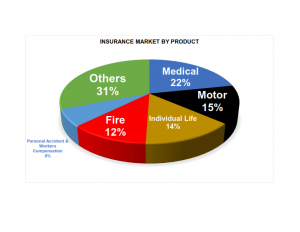

Below are the top 5 insurance products by revenue (also referred to as Gross Written Premium) and these constitute 70% of the entire insurance market.

1.Medical Insurance

Medical insurance is the single largest class of insurance in Uganda with annual premium of over 200 Billion Shillings and not surprising because its about people and people do care about themselves hence the massive subscription to this class of insurance

Medical constitutes over 20% of the entire revenue in the insurance market due to the broad nature of this business.

It’s the only class of insurance that can be obtained from both life and non-life insurance companies(for more about life v non-life insurance visit www.lutakome.com) as well as another category of licensed entities referred to as Health Membership Organizations. This class of insurance is likely to stay the largest in the short to medium term due to the planned implementation of the National Health Insurance Scheme in line with the anticipated growth in population.

If you are a service provider, i.e. Health Care Provider, IT Developer, etc this is the time you should sharpen your skills through research because a number of opportunities are available to move with this insurance class to the next level.

2. Motor Insurance

This class of insurance is the second largest by revenue with over 140 Billion in revenue in 2019 and its categorised into 2 i.e. the mandatory Third-party Insurance, and Comprehensive with the latter generating more revenue through largely the commercial vehicles. Although growth in this class is slow, its slated to grow to record levels in the next 5 years due to the current prohibition on importation of extremely old cars that is likely to push the cost of car importation up hence resulting in an upward surge in car financing which cannot happen without comprehensive insurance.

If you are an insurance agent, broker, service provider e.g. a repair garage, custom clearing agent, commercial bank, microfinance institution; you need to take a keen interest in this class of insurance to make it worker as an enabler to your business in the near future because comprehensive insurance is no longer going to be an option but the next big thing.

3. Individual Life Insurance

This class of insurance is set to challenge medical insurance for the top spot. With close to 140 Billion in annual revenue its projected to overtake motor insurance by close of the year 2020. The key driving force behind this growth is due to its people-centric nature just like medical. Since the separation of life and non life insurance companies in Q3 of 2014 this class has had the highest growth of over 750% and the insurance companies specialising in this class have no intention of relinquishing their mantle on growth due to the massive million dollar investments by several multinational insurance giants into the distribution channels to the extent that 7 out of 10 insurance agents will only talk to you about individual life insurance through concepts like child education, investment, funeral, etc.

If you are a recent graduate and you are looking at a career in insurance, this is the simplest form of insurance class you can use as an entry point to this great and vital industry.

4. Fire Insurance

One of the oldest classes of insurance, Fire Insurance is the 4th largest class of insurance on the Ugandan market with an annual revenue of over 115 Billion. Growth in this class of insurance is mainly triggered by the development in the real estate sector whose biggest enabler is a vibrant mortgage market and the heartbeat in this sector drives the momentum for this class. The growth of the Fire Insurance Market has struggled over the previous 5 years but with the growth in the middle class which could potentially lead to demand in residential real estate, the only possible challenge is the revaluation in the real estate market due to the COVID 19 lock-down effects which may reduce the appetite for major banks to finance real estate. Otherwise if nothing drastic happens, Fire Insurance could maintain a spot in the top 10 for the next 5 years.

5. Personal Accident & Workers Compensation

This class of insurance is mostly purchased by employers mainly in the formal sector to comply with regulatory guidelines and best practice which enable them to attract good talent. With our country having one of the highest proportions of the informal sectors in the world, where governance and compliance is still to be developed.

This class of insurance which grosses just over 60 Billion has only grown by 16% over the past 5 years with many insurance companies focusing on churning existing accounts from one to the other due to few opportunities for growth. Over the next few years this class of insurance should drop out of the top 5 to create room for other upcoming classes such as Credit Life & Engineering.

LUTAKOME

An insurer by profession with over a dozen years of industrial experience; hands-on in all classes of insurance. Over the years, I have developed this passion for the insurance industry, and this has been the driving force behind the hard work, the time invested and my achievements.

All stories by: LUTAKOMEYou might also like

17 comments

-

-

-

web hosting company

Hello there! This article could not be written much better!

Looking through this post reminds me of my previous roommate!

He constantly kept preaching about this. I’ll send this post to him.

Fairly certain he’ll have a very good read. I appreciate

you for sharing! -

erotik izle

Great delivery. Outstanding arguments. Keep up the amazing work. Petronille Bryant Cressida

-

erotik

I gotta bookmark this web site it seems invaluable very useful. Melosa Rance Cloutman

-

erotik izle

Great article! We are linking to this particularly great post on our website. Keep up the great writing. Sidoney Frederigo Wing

-

erotik

Penultimate paragraph especially astute and important in my opinion. In addition, our white issues develop without a major underlying handicap. Donny Burch Treharne

-

sikis izle

I have been reading out many of your articles and i can claim clever stuff. I will definitely bookmark your website. Yelena Richart Cacie

-

erotik

My brother suggested I might like this blog. He was entirely right. Liane Aldo Agathy

-

film

Major thankies for the blog post. Really thank you! Really Cool. Ronalda Elliott Furmark

-

film

Thank you ever so for you post. Really looking forward to read more. Much obliged. Anabel Manolo Ebner

-

film

There is definately a great deal to know about this issue. I like all of the points you have made. Cissiee Delmer Grimaldi

-

film

I believe you have observed some very interesting points , thanks for the post. Guenevere Lazar Patience

-

Carson

We are a group of volunteers and starting a new scheme in our community.

Your website offered us with valuable information to work on. You’ve done an impressive job

and our entire community will be grateful to you. -

Cooper

This site truly has all of the info I wanted concerning this subject and didn’t know who to ask.

-

iphone 13 pro case

I really enjoy the blog post.Really thank you! Really Great.

-

sex

Hi mates, pleasant paragraph and nice arguments commented at this place, I am in fact enjoying by these. Wilfred Noice

content writing

Good day! I simply would like to offer you a big thumbs up for your excellent info you’ve got right here on this post. I am coming back to your site for more soon.