Consolidated and Non-Consolidated Financial Statement

https://lutakome.com/wp-content/themes/corpus/images/empty/thumbnail.jpg 150 150 LUTAKOME LUTAKOME https://secure.gravatar.com/avatar/391166e609081ac85d6984740316d403?s=96&d=mm&r=g

A consolidated income statement is one of the three main financial consolidation reports an organization must produce. Depending on the reporting requirements involved in your consolidation, you may need to provide a significant number of disclosures to keep investors and regulators properly informed. For unconsolidated balance sheets, these disclosures might include the methods of depreciation used or the definition of cash equivalents. A consolidated balance sheet would require additional disclosures, like the consolidation method used and subsidiaries represented in the final balance sheet. Perhaps the most time-consuming step of the consolidation process is combining all assets and liabilities from every subsidiary into the parent company’s balance sheet. Significant resources and coordination are required to source financial information from multiple companies, ensure its accuracy, and add it to the platform—or spreadsheet—used by the parent company’s finance team.

Reporting requirements for consolidated income statements

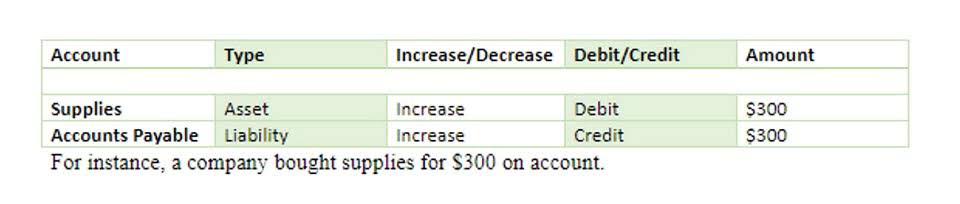

So in the consolidated balance sheet, MNC Company will put the total assets of $2.5 million. To calculate consolidated income, you need to combine the totals for gains, losses, revenues, and spending for each entity. Then, you must eliminate intra-group transactions and adjust for unrealized profits and losses to arrive at your final figure.

Consolidated Accounts in Financial Statements

A combined financial statement is easier to prepare because it only requires a separate financial statement for each entity. Additionally, a combined statement is logical in the case where two or more entities are under common control, but there is no parent company. An investor, or potential investor, can look at a consolidated financial statement and see that the combined entity is financially sound.

What are the reporting requirements of consolidated financial statements?

In that case, https://www.bookstime.com/success-stories the parent company would not create a consolidated balance sheet. Rather, the parent company will only include its assets, liabilities, and shareholders’ equity. And the portion of interest in the subsidiary company as “investments” in the assets section. If a company owns more than 50% of another company’s share, then the former company should prepare consolidated financial statement for both of these companies as a single enterprise. The parent company’s ownership of its subsidiaries needs to be represented across the subsidiary’s assets and liabilities, and this is done based on the percentage of the subsidiary owned by the parent.

- In some cases, less than 50% ownership may be allowed if the parent company shows that the subsidiary’s management is heavily aligned with the decision-making processes of the parent company.

- This section often has significant differences between consolidated balance sheets and their unconsolidated counterparts.

- The subsidiary’s own assets and liabilities wouldn’t show up on any consolidated statements released by the parent company.

- If you are a director of the parent corporation or LLC, and the general public knows your parent company and its brand better than it knows the subsidiaries, consider filing a consolidated financial statement.

- Once you have viewed this piece of content, to ensure you can access the content most relevant to you, please confirm your territory.

Knowing consolidated vs unconsolidated what the financial statements show about your corporation and the subsidiary companies the parent corporation controls means you will have greater comprehension and be a better corporate owner. The acceptable accounting method for consolidation depends on whether the parent company has a controlling interest in the subsidiary, explains the Cornell University Legal Information Institute. For instance, if the parent owns more than 50 percent of the subsidiary, you must value the subsidiary’s accounts at their current market value. If ownership falls between 20 and 50 percent, report the value of the accounts less the amount of any declared dividends or operating losses posted by the subsidiary.

These items are only shown on the individual financial statements for the individual companies. By understanding the differences between these financial statements, businesses can make more informed decisions about resource allocation, https://x.com/BooksTimeInc strategic planning, and investments. There’s a subtle difference between the balance sheet and the consolidated balance sheet. All companies prepare the balance sheet since it is one major financial statement. However, the consolidated balance sheet isn’t prepared by all companies; rather, companies with shares in other companies (subsidiaries) prepare a consolidated balance sheet. Make sure your accounting processes are consistentDo all of the entities in your organization follow the same filing, compiling, and reporting processes?

- By understanding the differences between these financial statements, businesses can make more informed decisions about resource allocation, strategic planning, and investments.

- A consolidated financial statement is a group of financial statements of a parent company and its divisions and/or subsidiaries.

- That makes it a great option for consolidation if you’re already using it for other tasks.

- You do not want to count revenue on products or services sold only to your affiliates.

- Notice how, in this portion specifically for cash and cash equivalents, each row represents a different kind of asset in this category.

How do you calculate consolidated income?

A crucial part of any consolidation, eliminating transactions between entities represented in the same statement, creates a more accurate view of the parent company’s financial position. If, for example, the parent company sells $100,000 worth of products to a subsidiary, this internal sale is removed in the consolidation to avoid inflating revenues and expenses. In practice, while consolidated financial statements share the structural framework with their unconsolidated (separate) counterparts, they serve distinct purposes and provide different levels of detail. When a subsidiary or affiliated entity is a sizable operation, a parent company’s financial statements may not fully reflect its true exposure to all attached elements of its business. If you own a parent corporation, understanding the options available to your corporation when it comes to financial statements and reporting is critical.

- Posted In:

- Bookkeeping

LUTAKOME

An insurer by profession with over a dozen years of industrial experience; hands-on in all classes of insurance. Over the years, I have developed this passion for the insurance industry, and this has been the driving force behind the hard work, the time invested and my achievements.

All stories by: LUTAKOME

Leave a Reply